When I first started learning about

Forex trading, I came across all sorts of chart patterns—Head & Shoulders,

Flags, Pennants, and many others. These patterns seemed like secret codes

traders used to predict price movements. Naturally, I was curious, and I wanted

to learn how to recognize them and make money from them. But let me tell you,

it wasn’t easy. I would see these patterns pop up on charts, but sometimes they

worked, and sometimes they didn’t. It was frustrating, especially when I saw

some experienced traders making fun of these patterns and saying they didn’t

work.

So, I asked myself: “Do patterns

like Head & Shoulders really work? Should I even care about them?” After a

lot of thinking, experimenting, and observing the market, I found an answer.

And now, I want to share my journey with you, because if you’re like me and

wondering whether these patterns can actually help your trading, the answer

might surprise you.

What Are Head & Shoulders Patterns?

At the most basic level, a Head

& Shoulders pattern is a price chart pattern that signals a potential

reversal in the market. That means it can tell you when a trend is likely to

change direction. The pattern is formed by three main parts:

- The Left Shoulder: This is the first peak or

high in the pattern. It happens after an upward movement in the price.

- The Head: This is the highest point in the

pattern. It follows the left shoulder and often represents a market peak

before a downtrend.

- The Right Shoulder: This peak is smaller

than the head and occurs after the head has formed. It’s often seen as a

"failure" to reach the highs of the head.

- The Neckline: This is the line that connects

the two low points formed by the shoulders. It’s an important level

because a break below this line is typically seen as confirmation that the

trend will reverse.

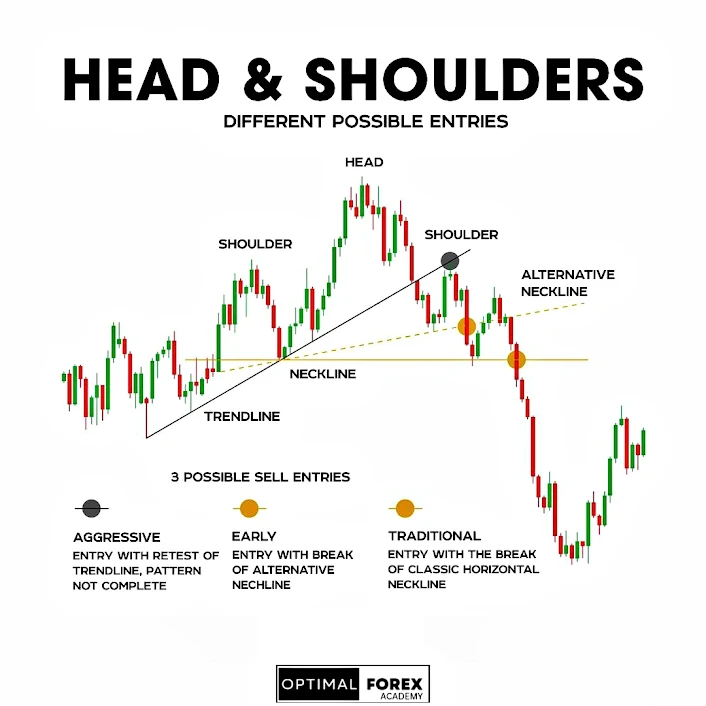

Here is a infographic that break down how a typical Head & Shoulders pattern happens on a chart:

There are 2 types of Head &

Shoulders patterns:

- Regular Head & Shoulders: This is a

bearish reversal pattern, usually occurring at the top of an uptrend. When

the price breaks below the neckline, traders see it as a signal that the

market is likely to go down.

- Inverse Head & Shoulders: This is a

bullish reversal pattern, usually found at the bottom of a downtrend. When

the price breaks above the neckline, it signals that the market is likely

to rise.

Now, you might be wondering, “Why

do these patterns work, and how can I use them to trade?” Well, the answer lies

not in the pattern itself but in the psychology behind it.

The Psychology Behind the Head & Shoulders Pattern

In my early days of trading, I

learned that chart patterns are not just about lines and shapes. They’re about

understanding the psychology of the traders involved. When I look at a Head

& Shoulders pattern, I don’t just see a set of peaks and valleys on a

chart—I see a story unfolding.

Here’s how I think the psychology

plays out in the Head & Shoulders pattern:

- The Left Shoulder: As the price rises,

traders are feeling good. The market has been climbing, and people are

excited. They think the trend will continue, but little do they know, the

end of the uptrend is near.

- The Head: The price climbs even higher. At

this point, many traders feel like they’ve missed out on the initial move

and think, “This is it! I’ll get in now!” They get greedy, and the market

pushes higher, creating the "head" of the pattern.

- The Right Shoulder: After the head, the

price starts to fall back down, and traders think, “Oh, this is just a

dip. I’ll buy the dip!” They hope the price will go up again, but instead,

it struggles to reach the highs of the head. This is when smart

money—experienced traders—start taking profits.

- The Breakdown: When the price falls again

and breaks below the neckline, panic sets in. Traders who were waiting for

the “dip” start to panic, and many exit the market, contributing to the

price drop.

This psychology is key to

understanding why the Head & Shoulders pattern can be so powerful. It’s not

just about the price levels, it’s about how traders react to those levels. When

enough traders start acting in the same way, it creates a self-fulfilling

prophecy that drives the price in the predicted direction.

Why Traders Struggle with Head & Shoulders Patterns?

As a beginner, I’ll admit—I

struggled with Head & Shoulders patterns. I would see one form on a chart

and think, “This is it! The market is about to reverse!” But more often than

not, the pattern would fail, and I’d lose money. So, what went wrong?

Through trial and error, I learned

a few common mistakes that traders make with Head & Shoulders patterns:

- Ignoring the Context: One of the biggest

mistakes is relying solely on the pattern without considering the bigger

picture. For example, if a Head & Shoulders pattern forms in the

middle of a strong uptrend without any key support or resistance levels

nearby, it’s more likely to fail.

- Not Waiting for Confirmation: Many traders

see a Head & Shoulders pattern and jump into a trade as soon as the

neckline is touched. But the pattern isn’t confirmed until the price

breaks the neckline and confirms the trend reversal. Entering too early

can lead to false signals.

- Overtrading Patterns: Just because a Head

& Shoulders pattern is forming doesn’t mean it’s a good time to trade.

The market doesn’t always follow textbook patterns, and trading every

pattern you see can lead to unnecessary losses. It’s important to pick

patterns that meet your strategy’s criteria.

- Not Considering Other Indicators: I’ve

learned that it’s dangerous to rely on patterns alone. I use other

technical indicators, like RSI (Relative Strength Index) or Bollinger

Bands, to confirm whether a Head & Shoulders pattern is likely to play

out. Without these additional tools, you’re flying blind.

How to Improve Your Success with Head & Shoulders Patterns?

After a lot of practice and

reflection, I’ve come up with a few tips to help you use Head & Shoulders

patterns more successfully. These aren’t magic tricks, but rather strategies

that will help you filter out false signals and improve your chances of making

profitable trades.

- Use Other Indicators for Confirmation

- RSI (Relative Strength Index): When I see a

Head & Shoulders pattern forming, I check the RSI. If it shows that

the market is overbought or oversold, it’s a good sign that the pattern

might be more reliable.

- Volume: Pay attention to the volume. A

strong breakout with high volume adds confidence to the pattern. If the

volume is low, be cautious.

- Candlestick Patterns: Look for confirmation

from candlestick patterns like doji or engulfing candles. These can give

you an extra layer of assurance before entering a trade.

- Be Patient—Wait for the Neckline Break

- Don’t rush in just because you see the pattern.

Wait for the price to break below (or above, in the case of the inverse

pattern) the neckline. This is the confirmation you need before making

your move.

- Trade with the Trend (When Possible)

- I’ve learned that Head & Shoulders patterns

work best when they align with the overall trend. For example, if a

regular Head & Shoulders pattern forms after an uptrend and the price

breaks the neckline, the reversal has a higher probability of playing

out.

- Focus on Higher Timeframes

- In my experience, Head & Shoulders patterns

are more reliable on higher timeframes, like the 4-hour or daily charts.

Patterns on smaller timeframes can be more random and less accurate, so I

focus on patterns that develop over a longer period.

- Don’t Trade Every Pattern

- Not all Head & Shoulders patterns are created

equal. Look for patterns that meet your specific criteria: key

support/resistance levels, confirmation from other indicators, and

patterns that align with the current market trend.

Real-Life Example - A Trade with a Head & Shoulders Pattern

Let me walk you through a real-life

example of how I used a Head & Shoulders pattern in a trade. A few weeks

ago, I noticed a regular Head & Shoulders pattern forming on the EUR/USD

4-hour chart. The market had been in a strong uptrend, and the price was

approaching a key resistance level.

- The left shoulder formed as the price pushed

higher, but traders were starting to feel like the market was getting

overbought.

- The head was the highest point of the

uptrend, and many traders jumped in, thinking the rally would continue.

- The right shoulder formed as the price

couldn’t reach the highs of the head, and this is when I started to notice

that smart money was taking profits.

When the price broke below the

neckline, I confirmed the pattern with a volume spike and an RSI that was

showing overbought conditions. I entered a short position, and the market moved

in my favor, confirming the Head & Shoulders pattern and delivering a

profitable trade.

Why Patterns Work (Even If They Don’t Always Lead to Profit)

The truth is, Head & Shoulders

patterns don’t always lead to success. Sometimes they fail, and that’s just

part of trading. Every pattern, no matter how well-formed, can result in a

loss. But even when they fail, they’re still valuable, because they teach us

important lessons about the market and how it behaves. Let me explain why

patterns like Head & Shoulders can still be useful, even if they don’t

always lead to profits.

First, patterns like the Head &

Shoulders reveal something about trader psychology. Traders—especially those

who are new to the market—often act in similar ways when they see certain price

levels. The Head & Shoulders pattern works because it captures the natural

reactions of traders: buying when the price goes up, hoping it will continue,

then selling when the price drops, trying to avoid losses. This psychology

creates predictable behavior that can be identified through patterns.

Even if the pattern doesn’t result

in a profitable trade, understanding the market's psychological moves gives you

an edge. You’ll start to recognize when traders are getting overly confident

and when fear or uncertainty starts to creep into the market. This can help you

anticipate the next move, whether it’s in your favor or not, and adjust your

strategy accordingly.

Here’s a breakdown of why patterns work, even if they don’t always lead to profit:

- They Reflect Market Sentiment: Patterns like

Head & Shoulders help you understand how the majority of traders feel

about the market. When prices go up and then fall, it shows traders are

losing confidence in the trend. When this happens, a reversal is often

more likely.

- They Provide Structure: Patterns give you a

framework to understand where the market might go next. Even if a pattern

fails, it helps you stay disciplined and stick to your trading plan. By

following the pattern, you limit emotional decisions that could lead to

impulsive trades.

- They Help with Risk Management: When you

spot a pattern and set stop-loss orders at strategic levels, you reduce

your risk. Even if the pattern doesn’t play out as expected, you’ve

protected yourself from large losses. This is why it’s essential to manage

your risk, no matter how confident you are in the pattern.

- They Encourage Patience: The Head &

Shoulders pattern teaches you to wait for confirmation. In many cases,

traders rush into trades too early, and that’s when patterns fail. By

waiting for the breakout or breakdown to confirm the pattern, you increase

the chances of a successful trade.

- They Keep You Focused on the Market’s True

Behavior: I’ve learned that trading isn’t just about predicting price

movement—it’s about reacting to the market in a structured, controlled

way. When you use patterns as part of your trading strategy, you’re more

focused on what’s actually happening in the market, rather than trying to

predict the impossible.

So yes, while Head & Shoulders

patterns don’t always lead to profit, they’re an invaluable tool in your

trading toolkit. They help you read the market’s behavior and teach you to be

patient, disciplined, and strategic in your approach.

Developing a Strategy That Works for You

By now, you might be thinking,

“Okay, I understand how the Head & Shoulders pattern works and why it’s

useful, but how do I make it part of my trading strategy?” Well, this is where

you need to create a strategy that works for you—one that fits your risk

tolerance, trading style, and goals. Here’s how I did it:

1. Start with the Basics:

Before diving into the Head &

Shoulders pattern, I made sure I had a strong grasp on the basics of trading.

This means understanding how price action works, how to read charts, and how

market trends behave. I also made sure I understood concepts like support and

resistance, which are key to recognizing when a Head & Shoulders pattern

might form.

2. Use Head & Shoulders as a Confirmation Tool:

Rather than relying solely on the

Head & Shoulders pattern, I use it as one piece of the puzzle. I don’t just

trade based on the pattern; I use other indicators to confirm what I’m seeing.

For instance, if I spot a Head & Shoulders pattern, I’ll check the RSI to

see if the market is overbought or oversold. If the RSI is showing that the

market is overbought, I feel more confident that the pattern will lead to a

reversal.

3. Set Clear Entry & Exit Rules:

One of the most important lessons

I’ve learned is to set clear entry and exit rules. I don’t just buy or sell

when I see the pattern; I wait for the neckline to break and confirm the

direction. Once I’ve made the trade, I set a stop-loss to limit my risk. I also

set a target based on support or resistance levels, so I know when to take

profits.

4. Practice in Demo Accounts:

If you’re just starting out, I

highly recommend practicing in a demo account first. This is how I was able to

test different strategies, including trading Head & Shoulders patterns,

without risking real money. It helped me get comfortable with identifying the

pattern, waiting for confirmation, and managing my risk.

5. Stay Disciplined and Stick to Your Plan:

It’s easy to get emotional during a

trade, especially when the market isn’t moving in your favor. But I’ve learned

that the key to long-term success is sticking to your trading plan. If you’ve

identified a Head & Shoulders pattern and your entry signal hasn’t been

triggered, don’t chase the trade. Wait for confirmation, and if it doesn’t

come, move on to the next opportunity.

Common Pitfalls to Avoid

While Head & Shoulders patterns

can be a great tool, they’re not foolproof. I’ve made my fair share of

mistakes, and I want to share some common pitfalls to avoid, so you don’t make

the same ones:

1. Not Waiting for Confirmation:

As tempting as it is to jump in

when you see a Head & Shoulders pattern forming, remember: confirmation is

key. I’ve been burned a few times by entering too early, thinking I could catch

the big move before it happens. But without confirmation—like a break of the

neckline—the pattern can fail, and you could end up losing money.

2. Trading Every Pattern:

Not every Head & Shoulders

pattern is worth trading. I’ve learned that it’s important to be selective.

Don’t trade every pattern you see. Instead, focus on patterns that form in

high-probability areas, like after a strong trend or near significant support

and resistance levels.

3. Ignoring Market Conditions:

The market is always changing, and

sometimes, patterns fail simply because market conditions have shifted. For

example, if there’s major news coming out, it could lead to a spike in

volatility that disrupts the pattern. Before entering a trade, I always check

for upcoming economic reports or events that could impact the market.

4. Letting Emotions Control Your Trading:

When the market doesn’t go the way

you expect, it’s easy to panic or make impulsive decisions. I’ve learned that

keeping my emotions in check is crucial to my success. If a trade goes against

me, I stick to my risk management rules and don’t chase losses.

My Final Thoughts - Head & Shoulders Patterns as a Trading Edge

Mastering Head & Shoulders

patterns has been a game-changer for me, but like all trading tools, they work

best when used with discipline, patience, and a solid strategy. While they

don’t always lead to profits, they provide valuable insights into market

psychology and can help you anticipate reversals before they happen. By using

them with other indicators, confirming patterns, and managing your risk, you

can increase your chances of success.

In the end, patterns like Head

& Shoulders are not just about lines on a chart—they’re about

understanding the behavior of traders and using that knowledge to make better,

more informed decisions. The more you practice and learn, the more confident

you’ll become in using these patterns as part of your trading strategy.

I hope this article has helped you

see how powerful the Head & Shoulders pattern can be when used correctly.

Remember, trading is a journey, and patterns like these are just one tool in

your trading toolbox. Keep learning, keep practicing, and most importantly,

stay patient. Success in trading doesn’t happen overnight, but with the right

strategies and mindset, you can achieve your goals.